Investing differently

Supporting your growth journey.

B & Capital is an active and independent investor supporting ambitious SMEs in their growth projects.

Our mission: to act as a catalyst for their transformation — sustainably.

OUR APPROACH

Accelerating growth

and transformation

for SMEs.

B & Capital supports SMEs in their growth and transformation projects — either as a majority or minority shareholder — working closely with their leadership teams. In partnership with Roland Berger, B & Capital helps ambitious SMEs deliver on their development plans and unlock their full potential.

What they say about us.

Leaders from both current and former portfolio companies share their views on the strength of our value proposition — and what it has helped them achieve.

A sustainable and responsible investment approach.

Because we believe that environmental, social, and governance (ESG) considerations are key drivers of long‑term value creation, we support every portfolio company on its sustainability journey.

NEWS

News & expert insights.

Paris, February 4, 2026

We are proud to announce that Humanskills, one of our portfolio companies, has been awarded the B Corp™ certification — one of the most rigorous labels for social, societal, and environmental impact.

Humanskills is now the second B & Capital portfolio company to join the B Corp™ community.

This recognition reflects the team’s long‑term commitment and highlights the progress pathways we strive to foster across our portfolio.

Congratulations to the entire Humanskills team on achieving this major milestone.

- ESG

Paris, January 28, 2026

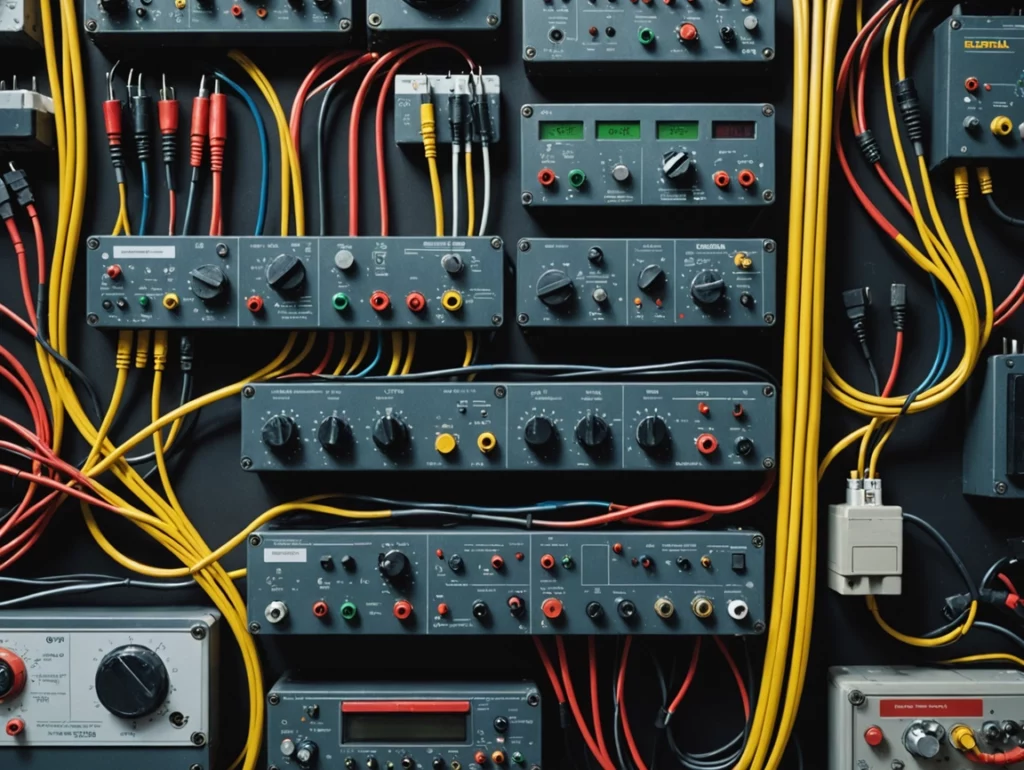

After five years of partnership, B & Capital and the management team of Phase Neutre (123 Elec), led by Michel Chavès, have finalized the sale of the group to Siparex Midcap as part of a majority LBO transaction.

A leading player in the online distribution of electrical equipment in France, 123 Elec has established itself as a reference platform, supported by strong double‑digit organic growth, nearly 400,000 orders per year, and a highly efficient digital infrastructure. Between 2019 and 2025, the group’s revenue increased from €43 million to over €90 million, confirming the robustness of its business model and the momentum achieved under B & Capital’s ownership.

Alongside its new investors, 123 Elec will continue its development, notably by strengthening its B2B offering, upgrading its digital tools, and exploring opportunities for external and international growth.

- Exit

Paris, December 18, 2025

DWS announces the entry of B & Capital into its shareholding structure as a cornerstone investor. This transaction marks a key milestone in supporting the Group’s growth, strengthening its international positioning, and diversifying its markets.

About DWS

Founded in 2017, DWS specializes in laser engraving and has established itself as an innovative player in the luxury sector thanks to its technological solutions and expertise.

- 2025 revenue: primarily generated with luxury brands

- Team: committed international workforce

- Footprint: Europe, the Americas, Asia

- Products & services: ultra‑personalization solutions, SaaS data analytics platform

Objectives of the partnership

- Accelerate growth in France and internationally

- Diversify target markets

- Strengthen organizational structure and enable key managers to become shareholders

- Consolidate DWS’s position as a strategic partner for prestigious luxury houses

- Acquisition

HERE TO LISTEN

A dedicated point of contact.

Because the best strategies are built through dialogue.